- Careers

- Investment Center

- Retail Partner

- Customer Login

- (833) 689-LOAN

- Apply Now

1st Franklin Financial Corporation is in the business of helping our friends and neighbors make their way through life with the dignity and respect they deserve.

We’re not a payday lender and we don’t offer loans secured against a customer’s next paycheck. We offer customers short and long term installment loans with payment plans that fit each customer’s need.

Today, with over 360 branches across the Southeast, we continue to offer personal loans and financial solutions so our customers can reach their goals and get back to living.

No hidden fees, no surprises. Just simple fixed rates, fixed payments, and no penalties for prepayment.

Since 1941, we have worked in local communities across the southeast to provide financial solutions for our customers and their families.

You could have the money you need to get everything back on track the same day. In some cases, in only a few hours!

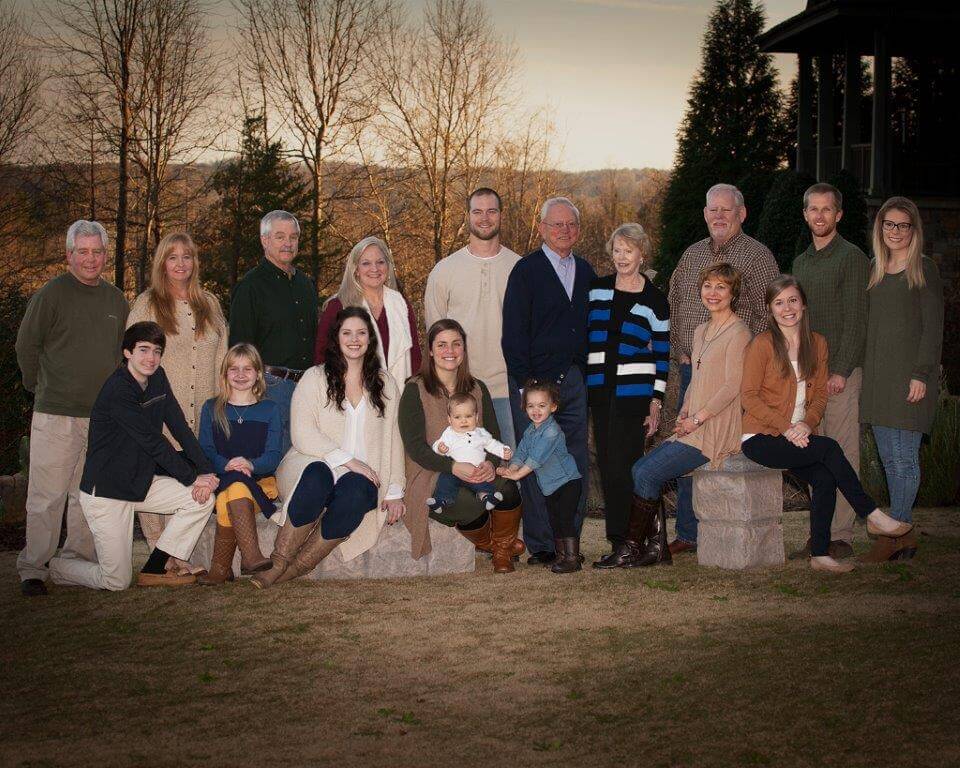

It’s been over 80 years since our founder Ben F. Cheek, Jr., made his first $34 loan. Since then, we’ve worked with generations of families to provide them with the funds they need when they need them the most. Our customers know us, but more importantly, we know them. While times have changed since 1941, our commitment to our customers remains the same.

1940's

In 1941, Ben F. Cheek, Jr. made his first auto loan for $34 from his law office in Toccoa, Georgia.

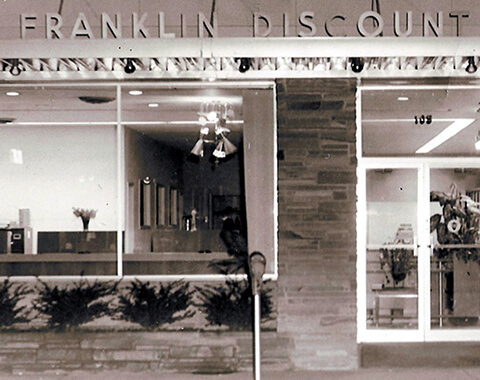

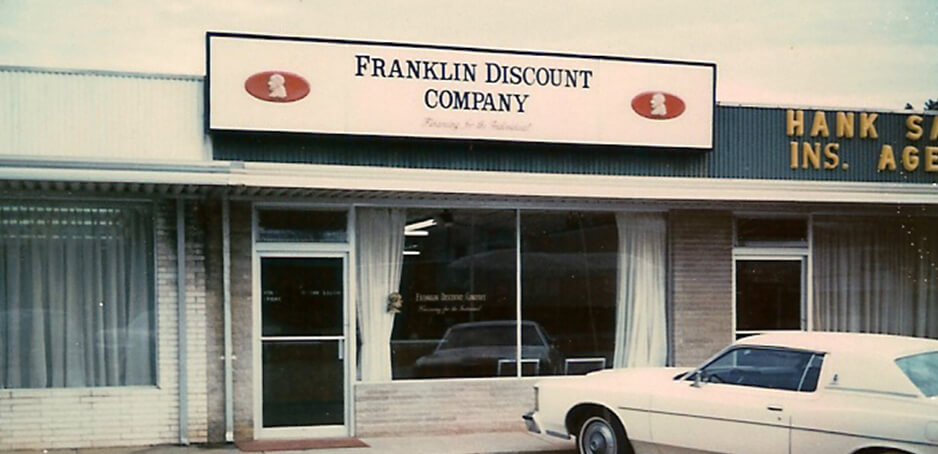

Entering the consumer finance industry as Franklin Discount Company, only a few loans were made those early months with operating capital coming from relatives, friends and local banks. The business incorporated in 1946 and moved into its own building in 1947. The Company expanded its services into insurance, particularly Credit Automobile insurance, in 1948.

1950's

In 1950, the Company expanded its services by selling investment securities to the public to finance its loan operation.

Beginning with its first sale of a $12 certificate, business grew to 200 local investors with purchases of $203,000 by 1955. 1st Franklin relocated in 1951 and remained as a one-office operation until 1955, when it began opening additional loan offices in Toccoa, Clarkesville, and Lavonia, Georgia. In 1956, Credit Life and Accident & Health insurance were added to the Company’s insurance offerings.

1960's

By 1960, the Company had 500 investment customers with purchases over $1,000,000.

With the number of investment customers increasing, the Company constructed a new Corporate Headquarters and Investment Center in 1966. Investment securities continued to grow, and by 1969 over $5,000,000 had been invested. But investment sales weren’t the only thing growing. By the end of the decade, loan services were operating out of 15 offices in the State of Georgia.

1970's

By 1970, the Company employed a total of 70 employees.

In 1972, Founder Ben F. Cheek, Jr. resigned as President of the Company turning over the reins to son, Ben F. Cheek, III. Ben Cheek, Jr. maintained an active role as Chairman of the Board until his death in 1988. In order to reinsure credit insurance written by the Company, the decision was made to form its own insurance company. This resulted in the formation of Frandisco Life Insurance Company. By the end of the 70’s, loans were being served out of 49 branches in Georgia, and investment sales had reached $14.8 million through 2,500 investment customers.

1980's

In 1983, the name “Franklin Discount Company” was replaced with “1st Franklin Financial Corporation.”

In 1984, construction was completed on a major expansion of the Corporate Headquarters and Investment Center facilities and remains the home office today. In 1987, loan operations expanded into neighboring South Carolina with the opening of the Clemson office. In September of 1988, Founder Ben F. Cheek, Jr. passed away, but his unfailing efforts to see each employee take pride in being fair, honest, and friendly to our customers continues today. 1st Franklin employees are still known as the “Friendly Franklin Folks.”

1990's

In 1991, 1st Franklin Financial celebrated its 50th Anniversary.

The number of branch offices had grown to 77 in Georgia and South Carolina. The 90’s were a decade of phenomenal growth for 1stFranklin Financial. Loan services in 1992 moved into Alabama, and in 1996 into Louisiana and Mississippi. By the end of the decade, the Company had 178 branch locations and 682 employees.

2000's +

The Company began the turn of the century looking forward to a new century of opportunity.

Investment customers had grown to over 6,100 with purchases of almost $150 million. Steady growth was seen over the next few years. In 2008, loan services moved into Tennessee with the opening of seven offices. By the end of the decade, the company opened 57 new offices, and employees now numbered over 1,000 across the Southeast.

In 2016, 1st Franklin celebrated its 75th anniversary. Today, the company continues its success. It has more than 319 branch offices located in six states and over 1,450 employees.

At 1st Franklin Financial, we are committed to extending goodwill through our branch locations. We feel strongly about supporting the communities where we live and work.

We not only support worthy local charities like homeless shelters and food banks, but also national organizations such as the American Cancer Society, American Heart Association, United Way, March of Dimes, St. Jude Children’s Research Hospital, Susan G. Komen Foundation, the U.S. Armed Forces, and more.

While we believe in supporting our communities, we believe in having fun while doing it! From 5K’s to costume contests for a cause, the 1st Franklin team enjoys building team spirit while helping others.

1st Franklin Financial is proud to support many youth sports and community initiatives that foster the values of teamwork and sportsmanship.

We believe that healthy employees are more fully engaged and happy. We try to encourage healthy behaviors in the hope that they become healthy habits.

Our employees continue to embody the spirit of giving by providing their time, money, and attention to those who need it most in the nine states we call home.